Start the week of July 18, 2022 with our Forex forecast focusing on major currency pairs here.

EUR/USD

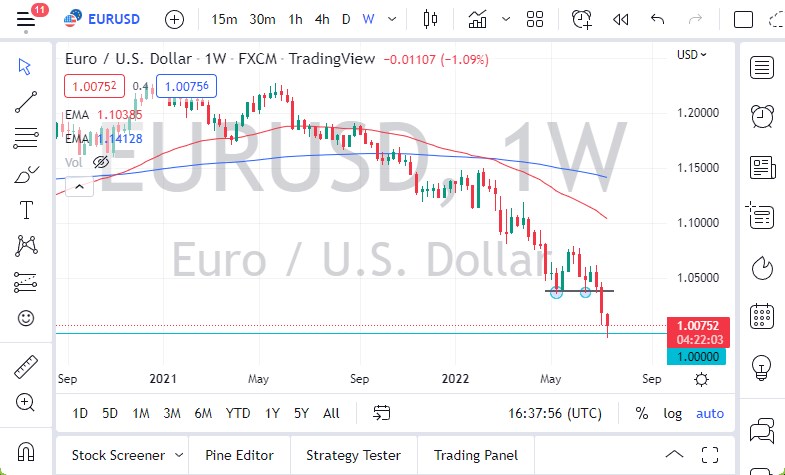

The euro has been all over the place during the week, as we have slammed into the parity level. However, we have held quite stubbornly in that area, so I think it’s likely that we could see a little bit of a short-term rally. Whether or not you choose to buy the euro is on you, but I will be waiting for signs of exhaustion after a rally to start getting short again. Prime candidates would be at the 1.02 level, and then the 1.04 level.

As long as the Federal Reserve continues to keep monetary policy tight, I don’t really care what the CB does. After all, they are going to raise interest rates soon, but they are so far behind the curve that the euro will continue to suffer.

GBP/USD

The British pound also plummeted a bit during the course of the week, testing the 1.18 level. I think at this point we also have a little bit of a recovery in the British pound, perhaps attempting to get back to the 1.20 level, which is an area that is a large, round, psychologically significant figure. After that, then we have the 1.22 level coming into the picture. Much like the euro, I will be looking to fade rallies at the first signs of exhaustion. More likely than not, I will be sitting on my hands at the beginning of the week.

USD/JPY

The US dollar continues to get overbought, and at this point in time, I think buying the USD/JPY pair is quite dangerous. Yes, we could continue to go higher, and you could even make the case for that being true several months ago. However, we are so overdone at this point in time that the risk to reward simply does not work out. On pullbacks, I could be a buyer, but I doubt it’s going to be anytime this week. Quite frankly, I would need to see more in the way of a pullback to offer value.

AUD/USD

The Australian dollar has also fallen during the course of the week but has also found quite a bit of support near the 0.67 region. At this point in time, I think the market will continue to try to recover, but the 0.70 level should be a massive resistance barrier that will be difficult to overcome anytime soon.

Ready to trade our weekly Forex forecast? Here are the best Forex brokers to choose from.