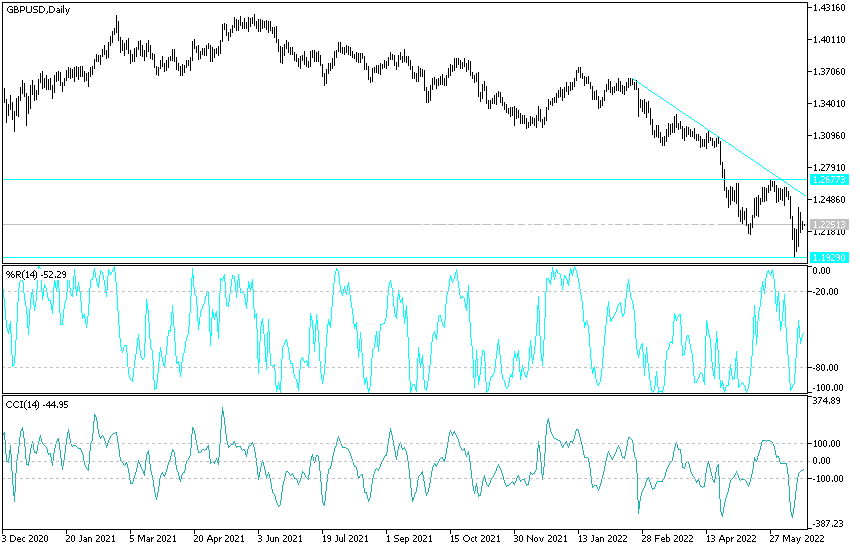

During last week’s trading, GBP/USD rebounded sharply from its March 2020 lows and could look to extend its recovery in the coming days. A lot depends on US bond yields and the impact of statements from Fed policy makers and a looming wave of UK economic numbers. The GBP/USD price collapsed below the psychological support 1.2000, which was expected since it fell to the 1.2175 support. The currency pair has settled around the 1.2260 level since yesterday.

The British pound slumped briefly below 1.20 against the dollar last week only to rebound to the 1.24 level last Thursday when the Bank of England (BoE) announced the fifth rate hike since December. This was followed by a sharp rise in market expectations for the bank rate over the coming months. Sterling was also helped significantly when the US dollar fell in general almost along with US government bond yields in the wake of the US Federal Reserve’s monetary policy decision for June.

While the increasingly “hard” market expectations of UK interest rates could be discouraged by either the Bank of England itself or any number of economic numbers set to emerge from the UK this week, they have so far provided a significant boost to the rate of the pound against the dollar. The rising bond yields in Britain combined with falling US yields to raise the spread or gap between these yields in a supportive way for the pound after the Federal Reserve economic forecast in June indicated that the bank was likely to raise US interest rates only as much as financial markets had I did that. Already envisaged for this year.

Last week, the Federal Open Market Committee (FOMC) took another important step toward meeting the inflation target by raising the federal funds rate target by 75 basis points.

To the extent that the above trend in the bond market continues, sterling may help reverse some of the sharp decline in the second quarter.

However, the risk is that the US dollar strengthens regardless of what happens in the bond market this week if comments from Federal Reserve Chairman Jerome Powell on Wednesday and Thursday, or other members of the Federal Open Market Committee (FOMC), exacerbate emerging concerns about the possibility of a US or even global recession in the near future. This is a possibility given the extent to which the Federal Reserve and other global central banks are increasingly focused on curbing inflation to rule out all other concerns including the potential fallout for the labor and employment markets.

According to the technical analysis of the currency pair: The price of the GBP/USD currency pair lacks the strength factors to break through the general bearish trend. As I mentioned before, the continuation of the pessimism of the Bank of England and the negative results of the British economic data negatively affect any attempts of the GBP/USD to rebound to the highest and closest levels. The resistance for the currency pair is 1.2320 and 1.2400 and I still prefer to sell the currency pair from every bullish level.

On the other hand, the return of the sterling dollar price to the vicinity of the support 1.2175 will support expectations again to move towards the psychological support level 1.2000, thus increasing the strength of the downward trend.