The Japanese yen fell to its lowest level against the dollar in 24 years as the growing gap between the monetary policy of the US Federal Reserve and the Bank of Japan attracts money towards the US. The USD/JPY currency pair recently reached the resistance level of 135.50 and the currency pair crossed the 135.19 level for the first time since 1998. Given the recent volatility, these extreme moves are only expected to continue, as the yen tests the thresholds key such as level 140 which could lead to the intervention of Bank of Japan Governor Haruhiko Kuroda.

The Japanese yen’s implied volatility has reached its highest levels since the outbreak of the pandemic amid uncertainty over global growth and the central bank’s aggressive policy to control the yield curve. With the spread between US and Japanese two-year government bonds at its widest since 2007, conditions are ripe for the US currency to maintain its upward trajectory. If the Fed raises 75 basis points on Wednesday as expected, it is likely to further strengthen the dollar.

US producer prices rose 10.8% in May from a year earlier, underscoring the continuing threat to the US economy from inflation that shows no sign of slowing. Yesterday’s report from the US Labor Department showed that the Producer Price Index which measures inflation before it reaches consumers, rose at a slightly slower pace last month than it did in April, when it jumped 10.9% from a year earlier, down from 11.5% annually. March gains.

On a monthly basis, producer prices rose 0.8% in May from April, higher than the previous month, when they rose 0.4%. Energy prices, led by gas, rose only 5% in May from April. The other big driver of price gains last month was the sharp 2.9% increase in the cost of trucking goods, a sign that supply chain problems are not yet fully resolved. Food costs have not changed.

The numbers suggest that price hikes will continue to erode Americans’ salaries and wreak havoc on household budgets in the coming months. Inflation has caused major political problems for US President Joe Biden and Democrats in Congress and forced the Federal Reserve into a series of rapid interest rate increases aimed at slowing the economy and dampening rate increases.

Last Friday, the government reported that inflation according to the US Consumer Price Index jumped to a new 40-year high of 8.6% in May, a surprise gain that disappointed expectations that price increases may slow. Gas and food costs rose sharply, spurred on by Russia’s invasion of Ukraine, but costs for rent, new and used cars, medical care and clothing also rose, evidence that inflation is spreading more widely across the economy.

The Fed is expected to raise the short-term interest rate by three-quarters of a point today, the largest increase since 1994, as it ramps up efforts to rein in high rates.

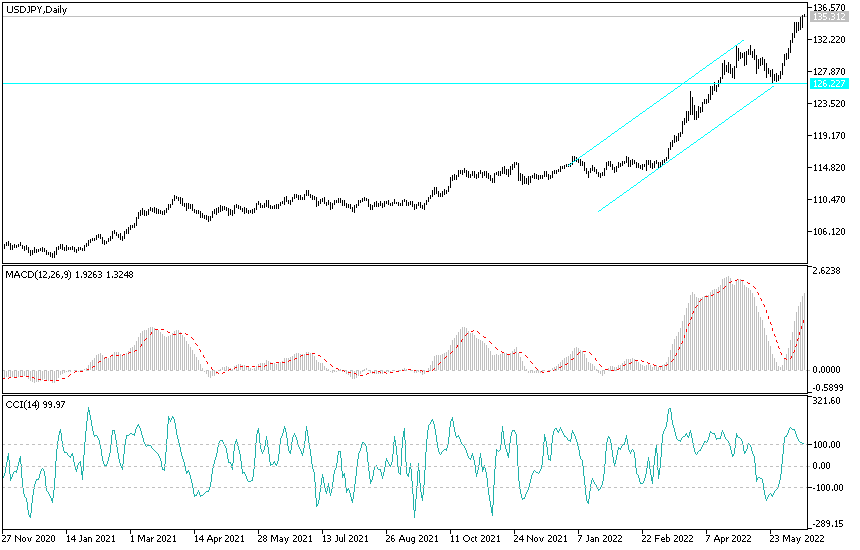

According to the technical analysis of the pair: the recent indications that there will be no intervention to stop the collapse of the yen until it reaches a price of 140 against the dollar. This allows the bulls to hold on to their record gains, which pushed the technical indicators on the USD/JPY chart towards strong overbought levels. If the decisions of the US Federal Reserve come in support of a strong path to raise the US interest rate, the bulls may head in the currency pair towards the resistance levels 136.30 and 137.75 before the specified top of the intervention.

On the other hand, if the US Central Bank’s announcement today is less hawkish, the dollar-yen currency pair may be exposed to profit-taking operations. There will not be a break in the general trend without moving below the 130.00 level.