[ad_1]

Be very cautious about how much you put in at any one time, and only add as the trade works out for you.

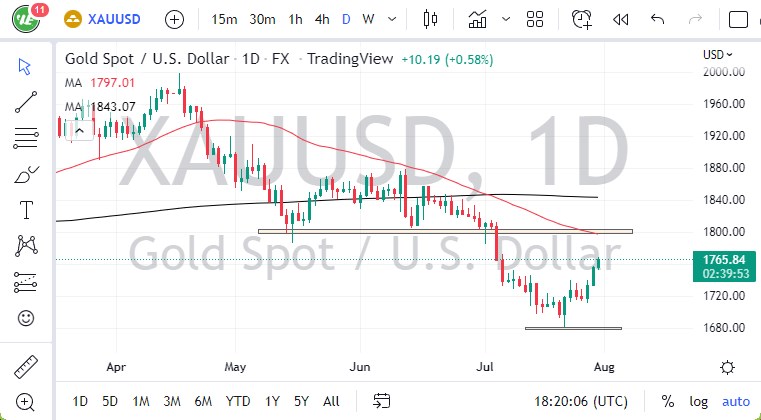

- Gold markets rallied Friday to close out the week on the good foot.

- At this point, the market looks as if it is ready to go much higher, perhaps reaching the $1800 level.

- The 50-day EMA is sitting near the $1800 level, so it all comes together in order to show signs of exhaustion.

Is There Enough Momentum?

The last three days have been very strong, and therefore I think it shows that there is plenty of momentum. However, the $1800 level is a major area to get above, and I think it would take a lot of effort to clear it. The $1800 level is a major region to pay attention to, so if we were to clear the area, gold really should take.

On the other hand, if we see any signs of exhaustion between here and there, it’s probably a nice selling opportunity. Ultimately, this will come down to what we see in the interest rate markets, as the 10-year yield has fallen quite significantly over the last several days as well. A lot of this comes down to the noise coming out of the Federal Reserve meeting, which of course people continue to see as a potential pivot by the Fed. I don’t think that’s necessarily the case, and it would not take much from the Federal Reserve governors to spook the market.

Regardless, it’s the interest rates that drive where we go next. If interest rates fall, and typically is good for gold and vice versa. Regardless, I think this is a situation where you need to be cautious about your position size, as although we have a lot of momentum in one direction, gold tends to be very volatile so I would be cautious regardless as to which direction you are trading.

If we do break above the $1800 level, then I would become more of a “buy-and-hold” type of situation. At that point, the market is likely to go on the way to the $2000 level. Regardless, I think you need to be very cautious about how much you put in at any one time, and only add as the trade works out for you. If we were to somehow turn around a break below the $1680 level, that opens up some massive selling pressure to the downside.

Ready to trade today’s Gold forecast? Here are the best Gold brokers to choose from.

[ad_2]