[ad_1]

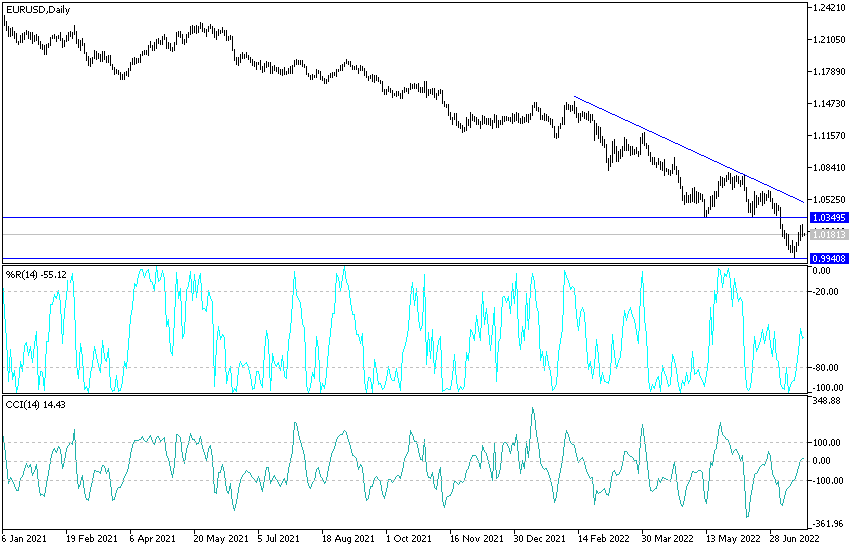

The EUR/USD currency pair reversed half of its July drop in a rally that could be an early warning of a market inflection point that is likely to provide many currencies with relief from the recent relentless rally of the US Dollar. The EUR/USD pair rebounded towards the 1.0272 resistance level, following hints of a half-point hike from the European Central Bank today, for the first time in 11 years. The EUR/USD is settling around the 1.0220 level at the time of writing the analysis, hours before the important bank announcement.

The euro’s gains came after Retuers and Bloomberg News reported that Thursday could lead to a significant rate hike from the European Central Bank (ECB). “Chief Economist Philip Lane will make a formal proposal at the meeting, and markets are now trying to gauge how many board members would be happy to support such a move,” says Chris Turner, global markets analyst at ING. Harding surprise, pushing the euro (from a broad-based perspective) sustainably higher remains a challenging task given the deteriorating growth outlook in Europe.

EUR/USD Economic Data

On Thursday, reports indicated that the European Central Bank will consider the idea of an immediate end to the era of negative interest rates in Europe by raising its three criteria for borrowing costs by 0.50%, which could raise the negative interest rate on deposits with commercial banks to zero. A 0.50% move today would be larger than a 0.25% move that was all but what was agreed previously by the Governing Council in June, and therefore could be more effective in limiting the extent to which the ECB risks further unwinding of Fed policy.

The price of the euro against the dollar has already tested the 1.02 resistance since the beginning of trading this week, after trimming nearly half of its decline in July in the trading sessions that followed the US inflation figures last Wednesday. This will also have important implications for the EUR/USD outlook.

Currently, futures markets are priced around 81 basis points for the July meeting. These diminishing expectations also keep the upside potential of the 10-year US Treasury yields under control and the downside potential of the EUR/USD pair,” says Philip Marie, senior analyst at Rabobank.

US inflation data last week was bleak to reveal a fresh 9.1% annual rate rise and a renewed acceleration of the core inflation rate month-on-month, but Fed officials were quick to pour cold water on the idea that this might be worth a faster pace of interest rate hikes.

Commenting on this, Jonathan Cohn, an interest rate trading analyst at Credit Suisse, said: “The price action may have understandably scared them, as it now appears that interest rate increases come at a cost.” He added: “The detrimental nature of front-loading amid recession fears means forecasts often speed up further exacerbating fears, leading to lower long-term yields, easing financial conditions on the net.”

Overall, cold water was poured in as three members of the Fed’s rate-setting committee quickly suggested that the current plan to raise rates to moderately restricted levels in 0.5% or 0.75% increments was still the most appropriate. Recent comments from Federal Reserve officials lowered market expectations for US interest rates, and that adjustment was subsequently reinforced when a University of Michigan survey showed consumers’ long-term inflation expectations lowered in July.

This is noteworthy because central banks believe that inflation expectations are self-fulfilling prophecies, and that low inflation is exactly what many of them are trying to achieve with their interest rate policies.

EUR/USD forecast today:

The EUR/USD price will remain in a narrow range around its gains until the European Central Bank announces the amount of interest rate hike and the tone of the monetary policy statement. Lagarde’s statements will determine the future of the euro’s gains or evaporate quickly. I still prefer to sell EURUSD from every bullish level as it continues to receive pressures from the economic recession amid Russia’s threat to the European energy sector. The closest targets are currently 1.0285, 1.0335 and 1.0420, respectively.

On the other hand, the stability of the currency pair below the support level 1.0075 will be important to push the Euro-dollar when the parity price is strong again.

[ad_2]