[ad_1]

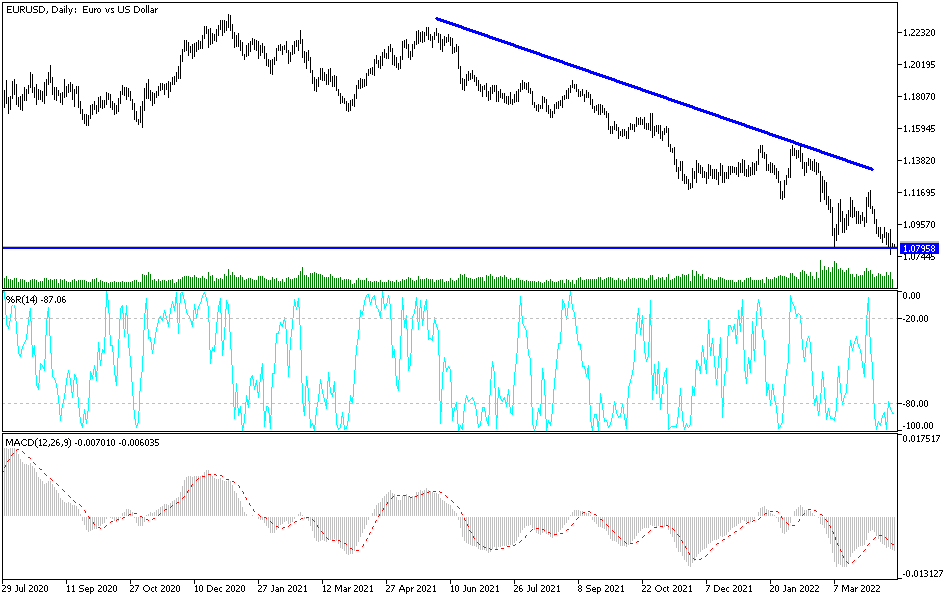

Last week’s trading was the most important for the bears to control the price performance of the EUR/USD currency pair, as the psychological support 1.0800 was finally breached. Expectations for months indicated the possibility of this happening. Bears’ control pushed the EUR/USD towards the 1.0757 support level, the lowest for the currency pair in two years. It closed the week’s trading stable around the level of 1.0811. As mentioned before, the continuation of the weakness factors is represented by the divergence in the economic performance and the future tightening of the central banks’ policy. This is led by the Federal Reserve in favor of the strength of the US dollar, in addition to the continuation of the Russian-Ukrainian war, which directly affects the future of the European economy.

On the economic side, the EUR/USD is trading with the European Central Bank’s vote to keep the benchmark interest rate and the deposit rate unchanged at 0% and -0.5%, respectively. Prior to that, it was announced that the EU’s ZEW survey of economic confidence for April fell from expectations at 0.2, with a negative reading of -43. The German data was impressive across many sectors.

From the US, the Retail Sales Monitor Group for March missed the forecast by 0.6% with a change of 0.5% (MoM). General Retail Sales for this period also came in below 0.2% with -0.1% reading, while Retail Sales outside of Automobiles exceeded the expected change (MoM) by 1% with a 1.1% change. Prior to that, it was announced that the producer price index excluding food and energy exceeded expectations, while the consumer price index excluding food and energy came in below estimates.

Commenting on the performance of the euro-dollar pair, Jordan Rochester, global FX analyst at Nomura Bank, says he expects the collapse in confidence in the eurozone to affect euro portfolio flows further. In short, the macroeconomic bigger picture matters more than politics and as a result the bloc’s single currency is vulnerable to further declines. Accordingly, the analyst adds in a special note, “For us, it is the macro, not Macron, that drives the vision.” And “political uncertainty in France provides another reason why the euro is not likely to trade well in the next two weeks, but it is not the only factor.”

Accordingly, the collapse of confidence in the euro area is likely to affect euro portfolio flows, and “real rates are not rising as fast as the United States, while ETF flows have slowed significantly,” according to the analyst.

He adds that the European Central Bank (ECB) is not likely to raise interest rates faster than the US Federal Reserve is doing, meaning that bond yields will still be skewed in favor of the dollar. This acknowledges the ECB’s view that it will indeed raise interest rates, but there is a risk that “the ECB likely won’t validate July’s pricing of a potential rate hike yet.”

These expectations come before the European Central Bank meeting, which was, according to expectations, kept interest rates unchanged and policy makers acknowledged the rise in inflation but sound caution about the damage to economic growth caused by the Russian invasion of Ukraine.

According to the technical analysis of the pair: In the near term and according to the performance on the hourly chart, it appears that the EUR/USD is trading within a coherent triangle formation. This indicates that there is no clear directional momentum in the market sentiment. Therefore, the bulls will target potential triangle breakout profits at around 1.0831 or higher at 1.0860. On the other hand, the bears will be looking for short-term profits at around 1.0786 or lower at 1.0756.

In the long term and according to the performance on the daily chart, it appears that the EUR/USD is trading within the formation of a sharp descending channel. This indicates a strong long-term bearish momentum in the market sentiment. Therefore, the bears will look to extend the current declines towards 1.0711 or lower to 1.0617. On the other hand, the bulls will target long-term profits at around 1.0897 or higher at 1.1000.

[ad_2]