[ad_1]

For four trading sessions in a row, the price of the euro currency pair EUR/USD was subjected to correctional selling after its recent gains towards the 1.1185 resistance. The selling operations pushed it towards the 1.0960 support level, and as mentioned before that breaking below the 1.1000 level will restore the bears to control the trend. The divergence in the future of tightening monetary policy of global central banks and the extent of vulnerability to the Russian-Ukrainian war will not be in favor of the continuation of any chance for the euro to make gains.

There are no major reports due from the Eurozone throughout the week, so investors may take cues from the US economy for the EURUSD pair. The release of the FOMC minutes could lead to strong volatility later. Remember that the Federal Reserve raised US interest rates in its latest policy decision, so traders are keen to see how seriously the central bank is taking its tightening plans. The data was mostly stronger than expected, especially in terms of inflation, so many are still hoping to see back-to-back hikes or even bigger increases in borrowing costs.

Any indication that the Fed is still playing it safe could dash hopes for a 0.50% hike at the next meeting, which could lead to losses for the US dollar.

Overall, the EUR/USD rate has eased from its high in late March, but it will likely suffer a deeper setback if the international response to alleged Russian atrocities in Ukraine leads to new volatility in energy markets over the coming days. A stronger dollar and uncertainty over prospects for a peace deal in Ukraine pulled the euro back from gains made in late March ahead of the weekend. The single European currency remained in full swing on Monday and may be at risk of further declines during the coming days.

Large increases in energy prices and risks of supply disruptions caused by the war in Ukraine have weighed heavily on the euro in recent weeks, more than offsetting the impact of European Central Bank (ECB) monetary policy that has steadily become less of a burden on the euro.

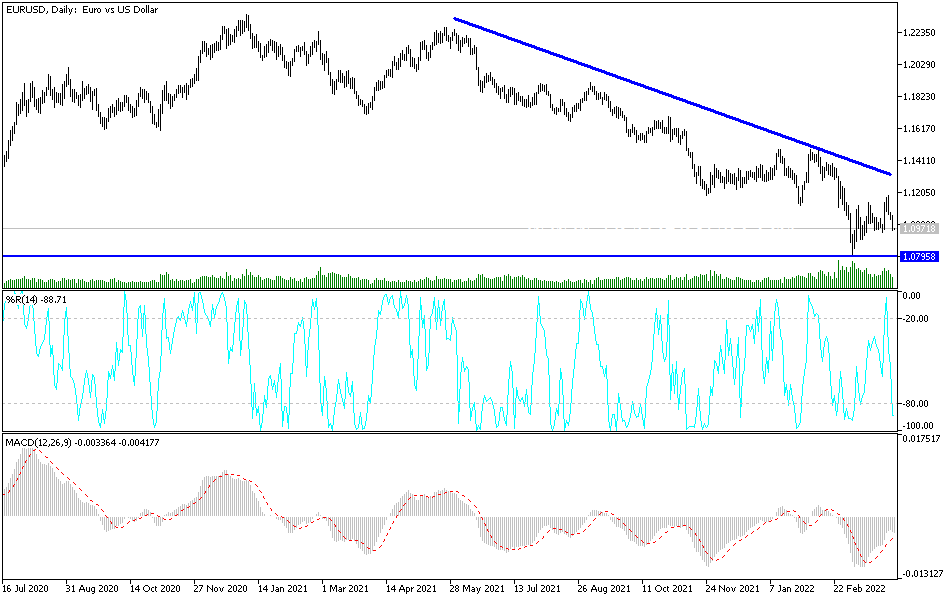

According to the technical analysis of the pair: The EUR/USD exchange rate is heading to the upside, forming higher bottoms and higher highs within an ascending channel on its short term time frame. The price is finding support in the area of interest around Fibonacci and the bottom of the channel. In particular, the 61.8% retracement level holds as support and lines up with the 200 SMA dynamic inflection point. A bigger pullback may find buyers at the key psychological level of 1.1000, just below the bottom of the channel, which might be the neutral correction line.

The 100 SMA is still above the 200 SMA to confirm that there is a chance for a correction in the near term, but in the long term the overall trend of the EUR/USD is still bearish. Any bullish momentum for the currency pair may not exceed the 1.1200 resistance. In the near term, stochastic is moving higher to show that buyers are in control, but the oscillator is approaching an overbought area to indicate exhaustion. The RSI is also trending higher and has more room to go up before reversing overbought levels.

[ad_2]